Which of These Best Describes Income Tax

Round to the nearest dollar. 1 to 9 999.

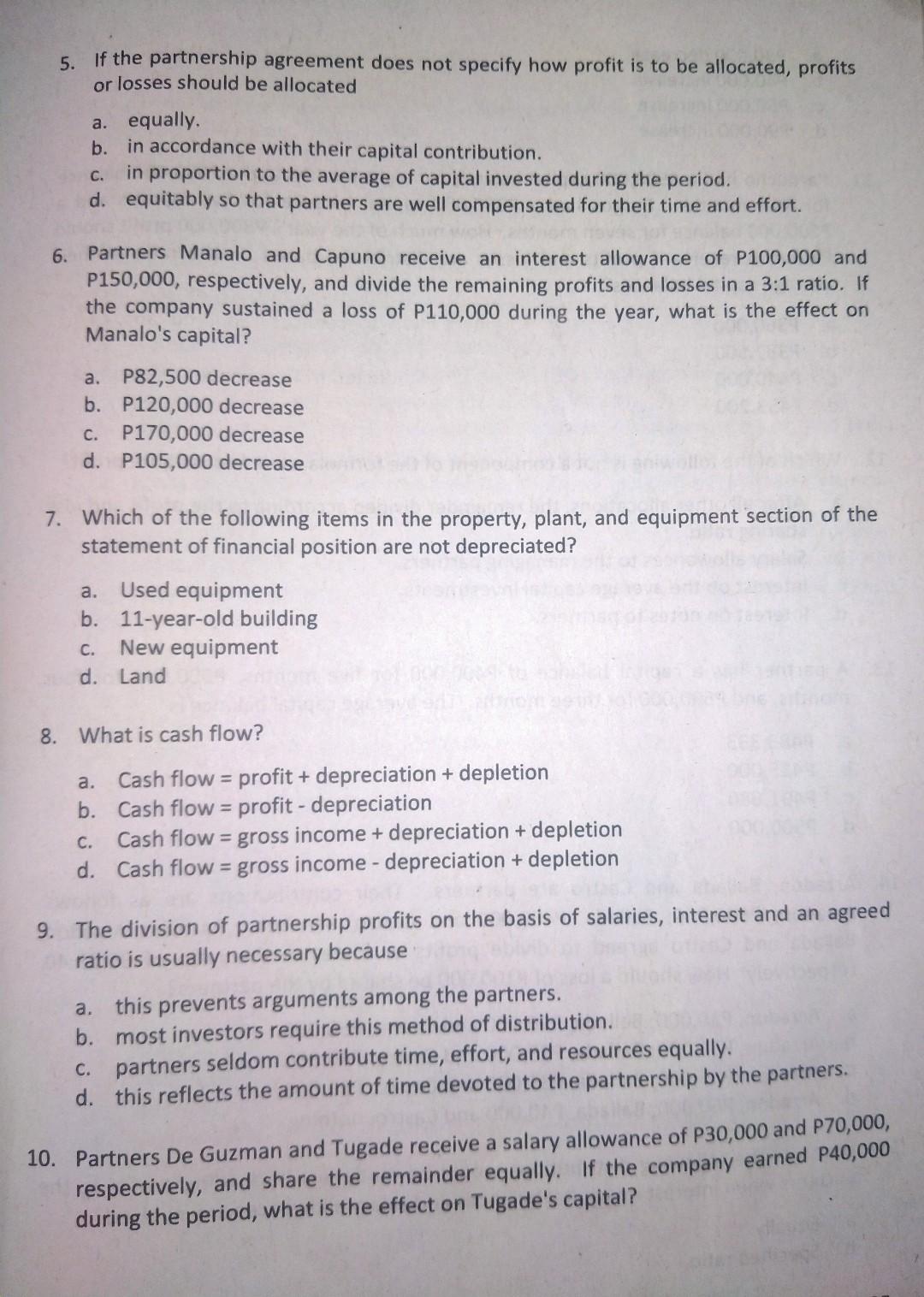

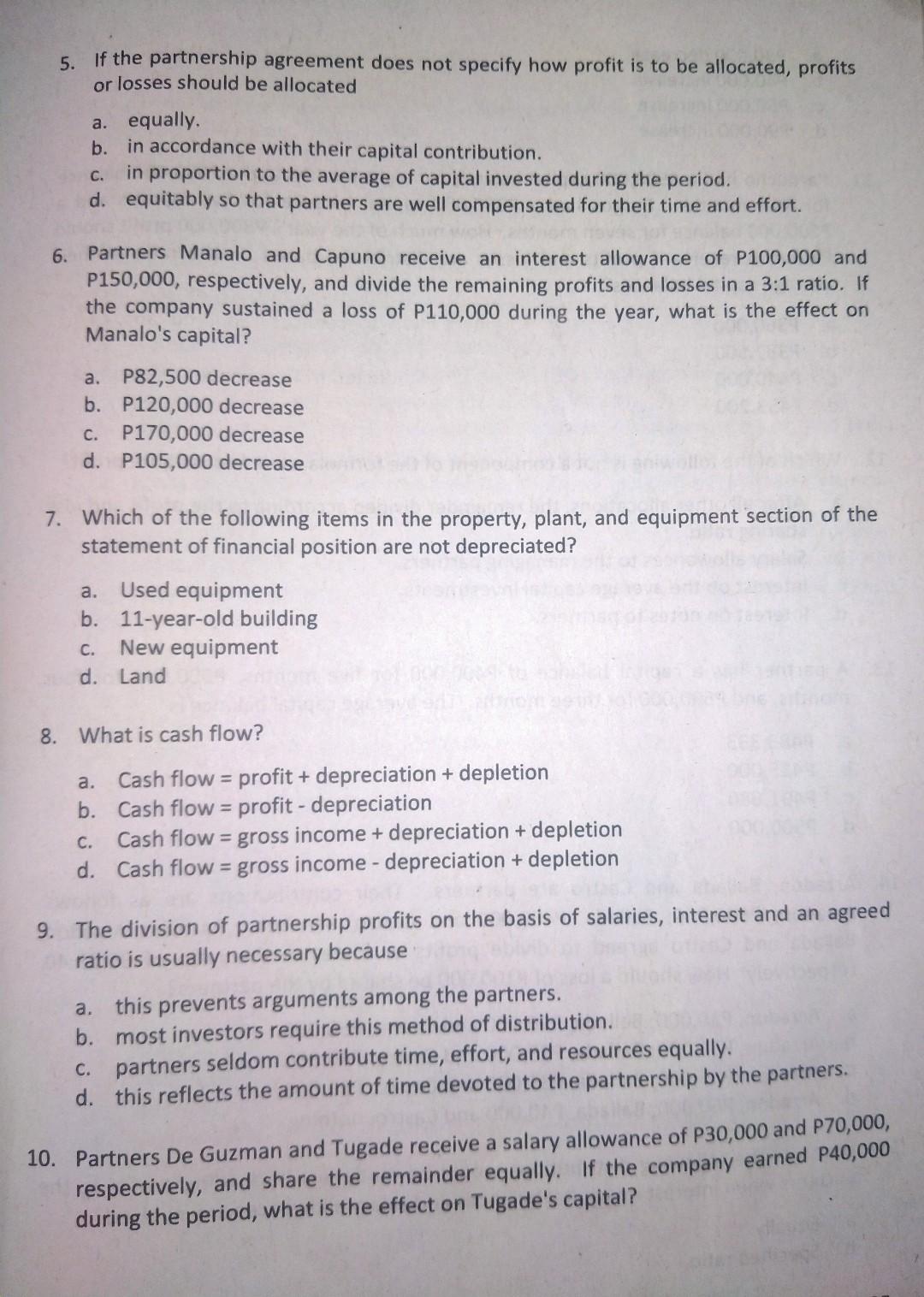

Fin 534 Final Exam Answers 2019 Exam Answer Exam Corporate Tax Rate

Correct answer - Which of these best describes income tax.

. Following best describes what is taken out of your total pay. OThe minimum wage increases from 760 to 810. Income taxes are also progressive because the that each person needs to pay is related to their income.

Here are a few examples of income survey questions most commonly used in good survey design. Subject to the cost recovery rule. Which phrase best describes the basis of seals taxes.

Which of the following statements best describes the purpose of the Taxpayer Bill of Rights. An is a tax issued by the federal government on imported goods. Loses the sight in one eye.

Federal income tax social security and Medicare contributions d. Social security and Medicare contributions 17. Top 10 Income survey questions for questionnaires.

The Federal income tax on corporations was held by the US. To protect domestic businesses. Which if any of the following statements best describes the history of the Federal income tax.

ATo grant to taxpayers the right to choose the time and method of payment of delinquent taxes bTo inform taxpayers of their rights in dealing with the IRS cTo inform taxpayers of the methods for properly completing their income tax returns dTo provide the IRS with additional enforcement. Value of the property. Which of these best describes income tax.

It generally applies to all taxpayers. O Justin is told by his employer that he is getting a pay cut in these lean economic times to save costs. The correct answer is income tax is a direct tax.

Subject to the value added. Property taxes are usually determined based on. The Constitution laws passed by Congress an executive order common law Which are examples of programs or projects most likely funded by taxes in the United States.

Households where the combined income is greater than 25000 pay an income tax whereas households earning less than that are paid a tax rebate. Which is not an application of a principle of a sound tax system. Subject to attachments from the insureds creditors.

A tax in which wage earners are taxed at the same percentage rate regardless of their income. Under the 2017 tax brackets and rates a single taxpayer with 40000 of taxable income would be in the 25 tax bracket and would have a tax liability of 5739. Regressive taxA tax that takes a larger percentage of income from low-income groups than from high-income groups.

Supreme Court to be contrary to the US. The direct tax describes income tax. Assume that the limitation of the age tax credit begins at 37500 and that the base amount of the credit is 7400.

Which of these best describes income tax. One spouse has net income for tax purposes of 47000 while the other spouse has net income for tax purposes of 0. Under the 2018 tax brackets and rates a single taxpayer with 40000 of taxable income would be in the 22 tax bracket and would have a tax liability of 4740.

Regressive tax progressive tax direct tax proportional tax Weegy. The increases when the income is. 2 question Which of these best describes income tax.

Further income survey questions can be asked to the targeted audience to find out appropriate pricing for their products. Progressive tax A tax that takes a larger percentage of income from high-income groups than from low-income groups. Check all that apply.

Which of these describes your personal income last year. Based on the performance of the SP. Direct taxes are for example income tax or property tax.

Assume that the limitation of the age tax credit begins at 37500 and that the base amount of the credit is 7 100. Choose the correct answer. Betty is 72 years old and has net income for tax purposes of 54000.

Up to 20 cash back 1. Loses the use of one hand. Loses hearing in one ear.

It existed during the Civil War. In a disability income contract an insured is considered to be totally disabled under the presumptive disability provision if heshe. Which of the following best describes the effect of tax condonation.

Which best describes a negative income tax. See answer 1 Best Answer. These taxes can be ignored since an increase in income tax expense for one company is offset by an equivalent reduction in Income Tax expense for the other.

At least once per year from when benefits begin. Death benefits from a life insurance policy are normally considered to be. Which of these best describes income tax.

It is conditional on the taxpayer paying some portion of the. Regressive tax progressive tax direct tax proportional tax What gives the US government the power to collect taxes. Federal income tax sales tax and social security contribution b.

A tax in which wage earners with higher incomes are taxed at a higher percentage rate than earners with lower incomes. Exempt from federal income tax. Which of these is most likely the US governments aim in taxing imported goods.

Exempt from federal income tax. Federal income tax property tax Medicare and social security contributions c. Proportional taxA tax that takes the same percentage of income from all income groups.

A direct tax is imposed on a person instution or property rather than on a transaction that is the case of indirect taxes. Regressive tax indirect tax direct tax proportional tax. What is the age tax credit for Bai under these assumptions.

Which of the following statements best describes the required accounting treatment with respect to income taxes on unrealized intercompany profits. Bai is 72 years old and has net income for tax purposes of 53 000. It only covers the unpaid balance of a tax liability.

What Emoji Describes Your Friday Night Friyay Friday Fridaynight Weekend Socialmedia Marketing Education Love Ne Describe Yourself Friday Night Night

Solved Multiple Choice 1 Which Of The Following Best Chegg Com

No comments for "Which of These Best Describes Income Tax"

Post a Comment